- Analyze your financial statements to understand your financial health better and identify improvement areas.

- Develop a realistic budget to control spending, avoid overspending, and ensure sufficient cash reserves.

- Invest in your business to attract new customers and increase revenue with minimal risk.

- Focus on customer satisfaction by providing excellent service, listening to feedback, and responding promptly to any issues.

- Have an effective investment management plan and diversify your portfolio by investing in various assets.

Managing a business’s finances can be a complex and challenging task, but it is essential for the long-term success of your company. Maximizing your business’s financial performance is about increasing revenue, cutting costs, and making smart investment decisions that will lead to growth and profitability. This guide will provide five tips to help you maximize your business’s financial performance.

1. Analyze Your Financial Statements

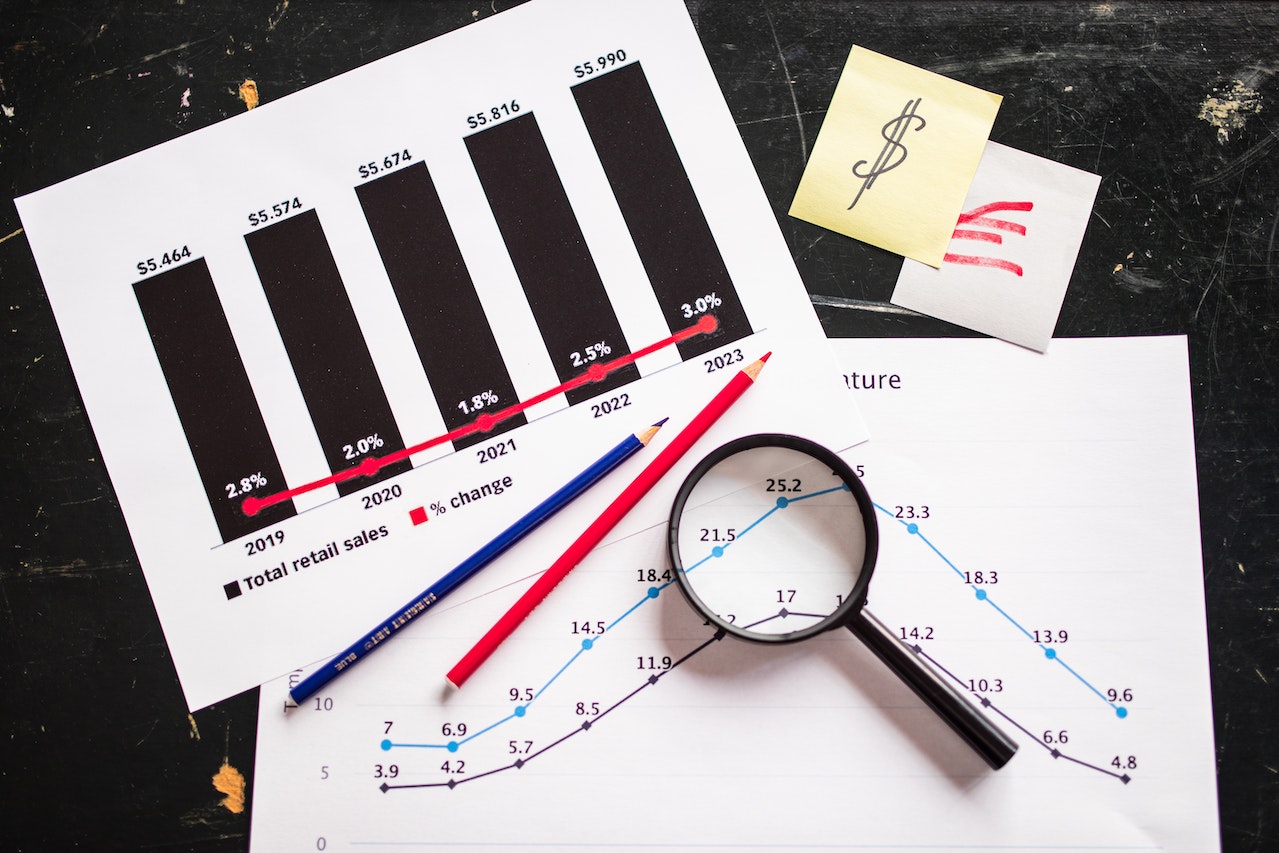

To maximize your business’s financial performance, it is crucial to analyze your financial statements regularly. By reviewing your income statement, balance sheet, and cash flow statement, you can better understand your business’s financial health and identify areas that require improvement.

Here are tips for analyzing your financial statements:

Review Your Income Statement

Reviewing your income statement can help you determine how much your business generates over a given period. This information is essential for monitoring trends in revenue and expenses, as well as calculating your profits. You can also use this data to identify areas where you may need to cut costs or increase sales. When reviewing your income statement, focus on the following: total revenue, operating expenses, cost of goods sold (COGS), and net profit/loss.

Analyze Your Balance Sheet

Your balance sheet provides an overview of your current financial position and assesses the value of your assets and debts at any time. Review your balance sheet and compare it to past statements to accurately understand your financial standing. Pay attention to the size of your company’s liabilities, cash reserves, and the value of investments.

Assess Your Cash Flow Statement

The cash flow statement shows how much money is coming in and going out of your business each month. By tracking this information over time, you can better understand where your money is being spent and identify areas for improvement. When analyzing your cash flow statement, look at key metrics such as operating, investing, and financing activities.

Monitor Debt Levels

High debt levels can significantly impact a business’s financial health, so keeping an eye on these levels when reviewing your financial statements is important. Consider the debt-to-equity ratio and compare it to past data to see if it has increased or decreased. Pay attention to loan payments, interest rates, and other factors that could be contributing to an overall increase in debt levels. By monitoring these metrics closely, you can stay on top of your business’s financial position and take action if necessary.

2. Develop a Budget

Developing a budget is another essential step in maximizing your business’s financial performance. A budget can help you plan and control your spending, avoid overspending, and ensure you have enough cash to meet your financial obligations. When developing your budget, be realistic about your revenue and expenses and set aside some funds for unexpected expenses.

To develop an effective budget, identify your fixed and variable expenses. Fixed expenses are those that don’t change from month to month, such as rent and salaries, while variable expenses fluctuate, such as utility bills and inventory costs. Use this information to create a flexible budget to accommodate changes in your revenue and expenses.

3. Invest in Your Business

Investing in your business can help you maximize your financial performance in the long run. Investing in new products, services, or marketing campaigns can attract new customers, increase your revenue, and gain a competitive advantage. However, it’s important to make informed investment decisions and avoid investing too much too quickly.

When investing in your business, consider the potential return on investment (ROI) and the risks involved. Look for investments with a high potential ROI and a low level of risk, and avoid investments that are too speculative or uncertain.

4. Focus on Customer Satisfaction

Customer satisfaction is another key factor in maximizing your business’s financial performance. You can increase customer loyalty, generate positive word-of-mouth, and attract new customers by providing excellent customer service and building strong relationships.

To improve customer satisfaction, train your employees to provide exceptional service, listen to customer feedback and complaints, and respond promptly to any issues. You can also use customer satisfaction surveys to gather feedback and improve your products or services.

5. Have an Effective Investment Management Plan

An effective investment management plan is critical for maximizing your business’s financial performance. Professional investment management can help you evaluate potential investments, create a diversified portfolio, and minimize risk while maximizing returns. A professional can also provide insight into macroeconomic trends affecting your investments and advise on the best strategies to achieve your goals.

When managing your investments, consider your risk tolerance, goals, and time horizon. Diversify your portfolio by investing in various assets, such as stocks, bonds, and real estate, and avoid putting all your eggs in one basket. Regularly review and re-balance your portfolio to align with your investment goals.

In Summary

Maximizing your business’s financial performance requires a combination of strategies, including effective investment management. By analyzing your financial statements, developing a budget, investing in your business, focusing on customer satisfaction, and managing your investments effectively, you can ensure that your business remains profitable and sustainable in the long run. You can maximize your financial performance and achieve success with the right strategies.